Prop Trading OANDA

Home » Prop firm

Program Overview

OANDA’s proprietary trading program provides funded trading opportunities for Malaysian traders. The program operates through structured evaluation phases assessing trading capabilities. Capital allocation follows successful completion of evaluation requirements. Risk management protocols maintain specific operational parameters. Trading opportunities span multiple financial instruments available through OANDA platforms.

Evaluation Process Steps

Phase 1 Assessment:

- Initial capital: 44,800 MYR

- Duration: 30 trading days

- Profit target: 8% minimum

- Maximum drawdown: 5%

- Minimum trading days: 15

Phase 2 Verification:

- Capital increase: 89,600 MYR

- Duration: 60 trading days

- Profit target: 5% minimum

- Maximum drawdown: 4%

- Consistent performance evaluation

Trading Requirements

The program implements specific trading parameters ensuring systematic risk management. Position sizing maintains proportion to account balance requirements. Trading hours align with major market sessions. Instrument selection follows program guidelines. Maximum leverage utilization receives systematic monitoring.

Capital Structure

| Account Level | Starting Capital (MYR) | Profit Share | Max Drawdown |

| Standard | 44,800 | 70% | 5% |

| Advanced | 89,600 | 75% | 4% |

| Professional | 179,200 | 80% | 3% |

| Elite | 448,000 | 85% | 2% |

| Institutional | 896,000 | 90% | 1% |

Risk Management Rules

Position sizing requires adherence to specific percentage limitations. Stop-loss implementation maintains mandatory status for all positions. Maximum daily loss limits protect capital preservation. Weekend position holding follows specific guidelines. Risk calculation tools assist parameter maintenance.

Technical Support

Infrastructure

Technical support maintains availability through dedicated communication channels. Platform issues receive immediate attention through specialized teams. Trading system access undergoes continuous monitoring ensuring stability. Malaysian traders access support through regional service centers. Response times follow systematic prioritization protocols.

Educational Resources

Available Training Materials:

- Risk management modules

- Trading psychology courses

- Technical analysis training

- Market fundamentals education

- Platform operation guides

Trading education provides comprehensive knowledge development opportunities. Course completion contributes to evaluation consideration. Educational resources undergo regular updates ensuring current market relevance.

Performance Monitoring Systems

Trading activity undergoes continuous evaluation through automated systems. Performance metrics track multiple aspects of trading behavior. Malaysian traders receive regular performance reports through dedicated channels. Analysis tools provide detailed trading statistics. The system maintains comprehensive trading history records.

Profit Distribution

Profit sharing occurs through monthly settlement procedures. Payment processing follows standard banking protocols. Malaysian traders receive earnings through local banking channels. Performance bonuses apply to consistent achievement records. Profit calculation includes consideration of trading costs.

Program Benefits

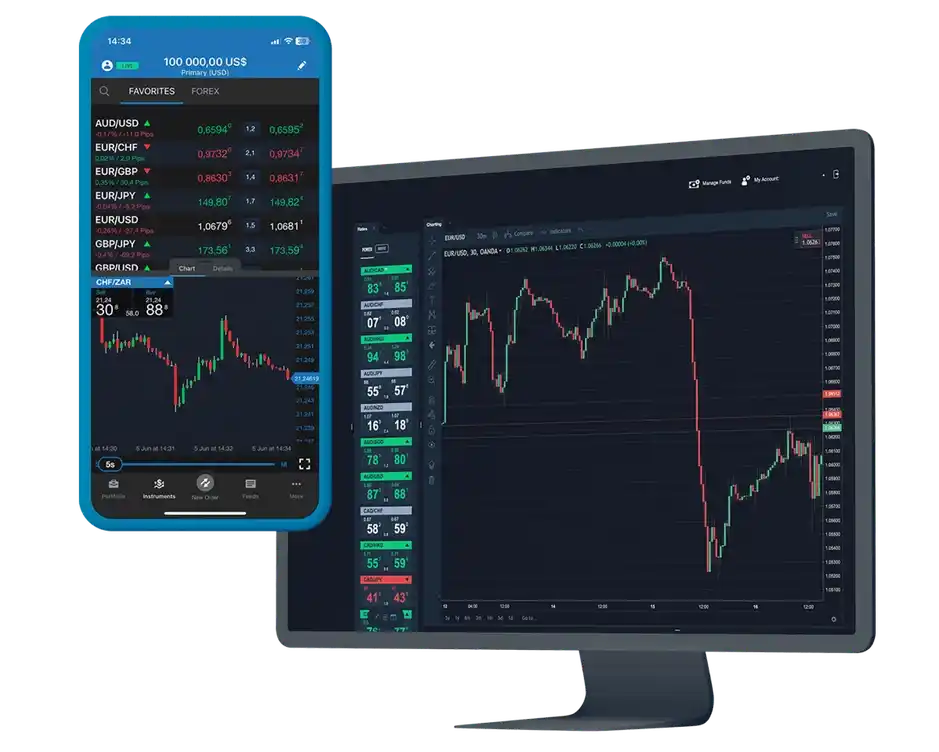

Available Features:

- Access to institutional grade platforms

- Professional trading tools

- Market analysis resources

- Technical support access

- Performance analytics

- Educational materials

- Trading community access

Evaluation Criteria

Trading consistency receives primary consideration during evaluation. Risk management implementation undergoes systematic assessment. Profit target achievement requires specific methodologies. Trading strategy demonstration shows systematic approach. Performance metrics undergo regular review processes.

Advanced Trading Tools

Available Resources:

- Real-time market analysis

- Economic calendar integration

- News feed access

- Technical indicator suites

- Position management tools

Program Progression Paths

Performance achievement enables program level advancement opportunities. Capital allocation increases follow systematic evaluation procedures. Trading parameter adjustments reflect progression requirements. Support services expand through advancement levels. Professional development continues through systematic progression.

Risk Assessment Protocols

Evaluation Metrics:

- Maximum drawdown tracking

- Position size monitoring

- Leverage utilization analysis

- Trading frequency assessment

- Risk-reward ratio calculation

Account Management Features

Control Options:

- Position size calculation

- Risk parameter settings

- Trading hour limitations

- Instrument selection tools

- Performance tracking systems

Strategy Development Support

Trading strategy development receives systematic guidance through program resources. Technical analysis tools support strategy formation processes. Market analysis provides fundamental trading insights. Strategy testing utilizes historical data access. Performance evaluation assists strategy refinement.

Compliance Requirements

Program participation requires adherence to specific regulatory guidelines. Documentation submission follows Malaysian compliance standards. Trading activity maintains alignment with program parameters. Regular compliance reviews ensure continued adherence. Support staff assists with compliance maintenance.

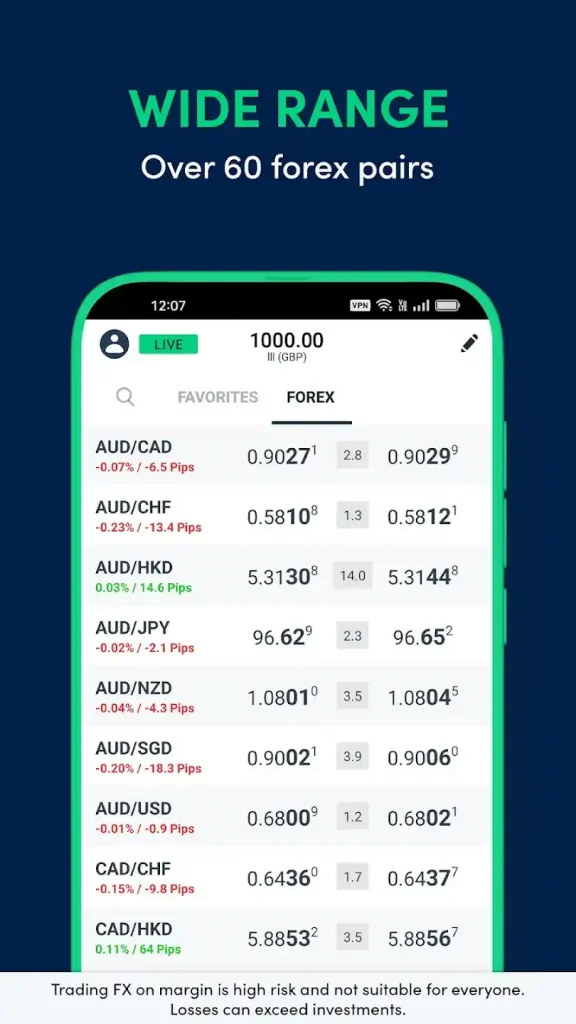

Market Access Features

Trading platforms provide comprehensive market access capabilities. Instrument selection spans multiple asset classes maintaining diversity options. Execution systems ensure efficient order processing. Market depth information supports trading decisions. Platform functionality undergoes regular enhancement.

Community Integration

Trading community access provides peer interaction opportunities. Knowledge sharing occurs through structured channels. Experience exchange maintains educational value. Community guidelines ensure constructive interaction. Support staff moderates community participation.

Performance Analytics

Tracking Metrics:

- Win-loss ratios

- Average trade duration

- Risk-adjusted returns

- Maximum drawdown periods

- Consistency measurements

Statistical analysis provides comprehensive performance evaluation. Trading patterns undergo systematic assessment determining strategy effectiveness. Performance improvement receives dedicated support attention.

Frequently Asked Questions

Malaysian traders must complete account verification, demonstrate trading knowledge, and maintain compliance with program trading parameters.

Profit distribution processes through Malaysian banking channels following monthly performance evaluation and settlement procedures.

Trading strategies must demonstrate systematic risk management, avoid excessive leverage, and maintain consistent performance within program parameters.