Minimum Deposit OANDA

Home » Minimum deposit

Account Types Overview

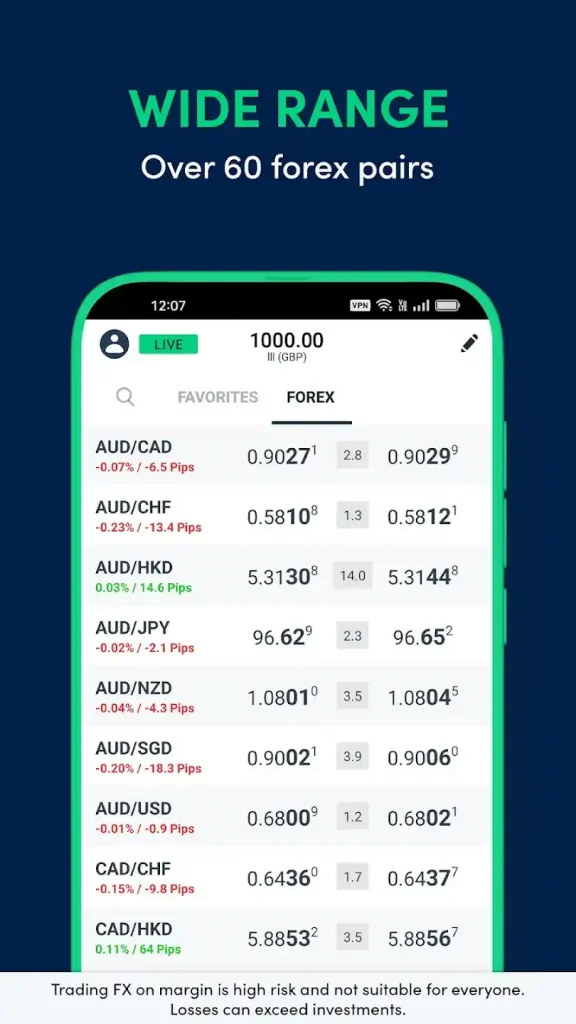

OANDA Malaysia provides multiple account options with varying minimum deposit requirements. Account selection affects available trading features and conditions. Malaysian traders access specialized account structures through regional services. Initial deposit requirements determine account classification levels. Account upgrades maintain specific deposit thresholds.Deposit Requirements Structure

| Account Type | Min Deposit (MYR) | Trading Features | Support Level |

| Standard | 0 | Basic Platform | Standard |

| Premium | 44,800 | Advanced Tools | Priority |

| Professional | 89,600 | Full Features | Direct |

| Elite | 448,000 | Custom Solutions | Dedicated |

Deposit Methods

Available Options:

- Local Bank Transfer

- International Wire

- Credit/Debit Cards

- E-wallet Systems

- Payment Processors

Processing Times

Local bank transfers complete within 1-2 business days. International transfers require 2-5 business days processing. Electronic payment methods provide immediate deposit confirmation. Processing times vary based on selected payment method. Malaysian banking systems maintain specific processing schedules.

Account Features by Deposit Level

Standard Account Benefits:

- Basic trading platform access

- Standard spreads

- Regular support access

- Basic educational materials

- Standard analysis tools

Premium Account Additions:

- Advanced trading tools

- Reduced spreads

- Priority support

- Advanced education

- Enhanced analytics

Account Maintenance

Minimum balance requirements maintain account activation status. Trading activity affects account maintenance conditions. Account status monitoring provides systematic oversight. Balance notifications alert specific threshold levels. Maintenance procedures follow established protocols.

Security Protocols

Deposit security maintains multi-layer protection systems. Transaction verification follows systematic protocols. Malaysian banking regulations guide security measures. Encryption systems protect transaction data. Account protection implements current security standards.

Currency Conversion

Malaysian Ringgit deposits undergo systematic conversion processes. Exchange rates follow current market conditions. Conversion fees apply according to payment method selection. Multi-currency account options available for qualified deposits. Currency conversion documentation provides transaction details.

Deposit Verification

Account funding requires specific documentation verification. Malaysian regulatory compliance guides verification procedures. Processing begins following documentation completion. Support staff assists with verification requirements. Document submission follows secure protocols.

Corporate Account Deposits

Requirements List:

- Company registration documents

- Director identification

- Business verification

- Banking details

- Trading authorization

Corporate accounts follow enhanced verification protocols. Malaysian business regulations guide documentation requirements.

Deposit Bonus Programs

Eligibility Requirements:

- Initial deposit thresholds

- Account verification status

- Trading volume criteria

- Time period limitations

- Regional availability

Bonus terms maintain specific trading requirements. Malaysian traders receive regional program access.

Corporate Account Deposits

Requirements List:

- Company registration documents

- Director identification

- Business verification

- Banking details

- Trading authorization

Corporate accounts follow enhanced verification protocols. Malaysian business regulations guide documentation requirements.

VIP Account Services

High-deposit accounts receive specialized service access. Dedicated support provides enhanced assistance availability. Custom solutions address specific trading requirements. VIP services include specialized market analysis. Account management receives priority attention.

Withdrawal Procedures

Processing Steps:

- Verification confirmation

- Balance assessment

- Method selection

- Fee calculation

- Transfer execution

International Transfer Options

International deposits require specific documentation requirements. Currency conversion follows systematic procedures. Transfer methods vary by region availability. Processing times depend on selected methods. International banking protocols guide transfer processes.

Account Upgrade Path

Progression Requirements:

- Deposit threshold achievement

- Trading volume maintenance

- Account standing verification

- Documentation updates

- Performance review

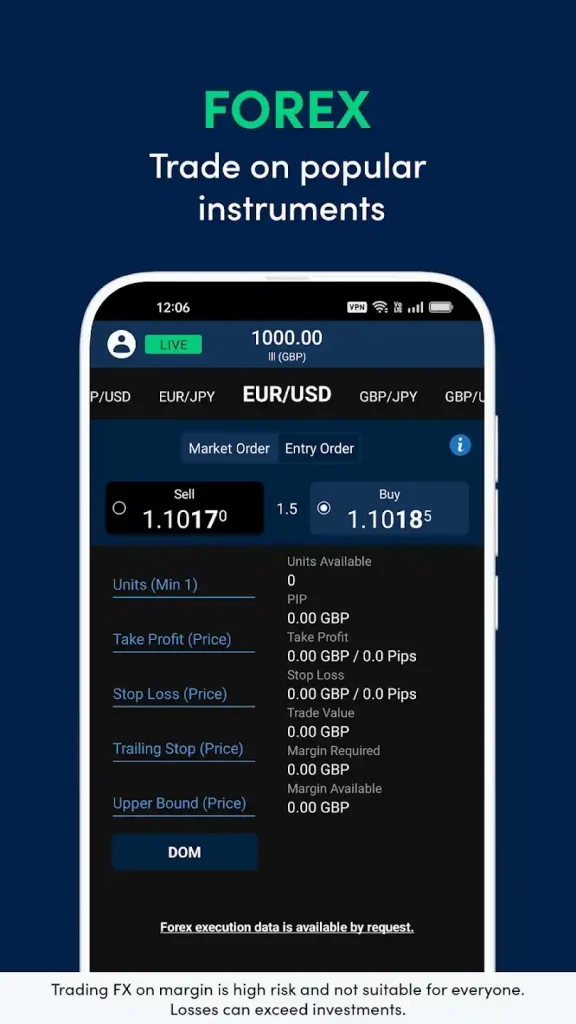

Mobile Deposit Options

Application Features:

- Secure payment processing

- Document upload capability

- Verification status tracking

- Balance monitoring

- Transaction history

Support Services

Dedicated teams assist deposit procedure completion. Malaysian support provides local banking guidance. Documentation assistance ensures proper submission. Processing queries receive systematic response. Support channels maintain consistent availability.

Educational Resources

Available Materials:

- Deposit guides

- Account management tutorials

- Payment system instructions

- Security protocol education

- Verification process guides

Risk Management Features

Position sizing tools assist capital allocation decisions. Risk calculation incorporates deposit amounts. Management systems protect account balances. Trading limitations align with deposit levels. Protection measures maintain account security.

Frequently Asked Questions

Malaysian identification, proof of residence, and fund source documentation require submission following regulatory requirements.

Conversion rates follow current market conditions with transparent fee structures applied to non-MYR deposits.

Account upgrades depend on deposit amounts, trading volume, and account maintenance history